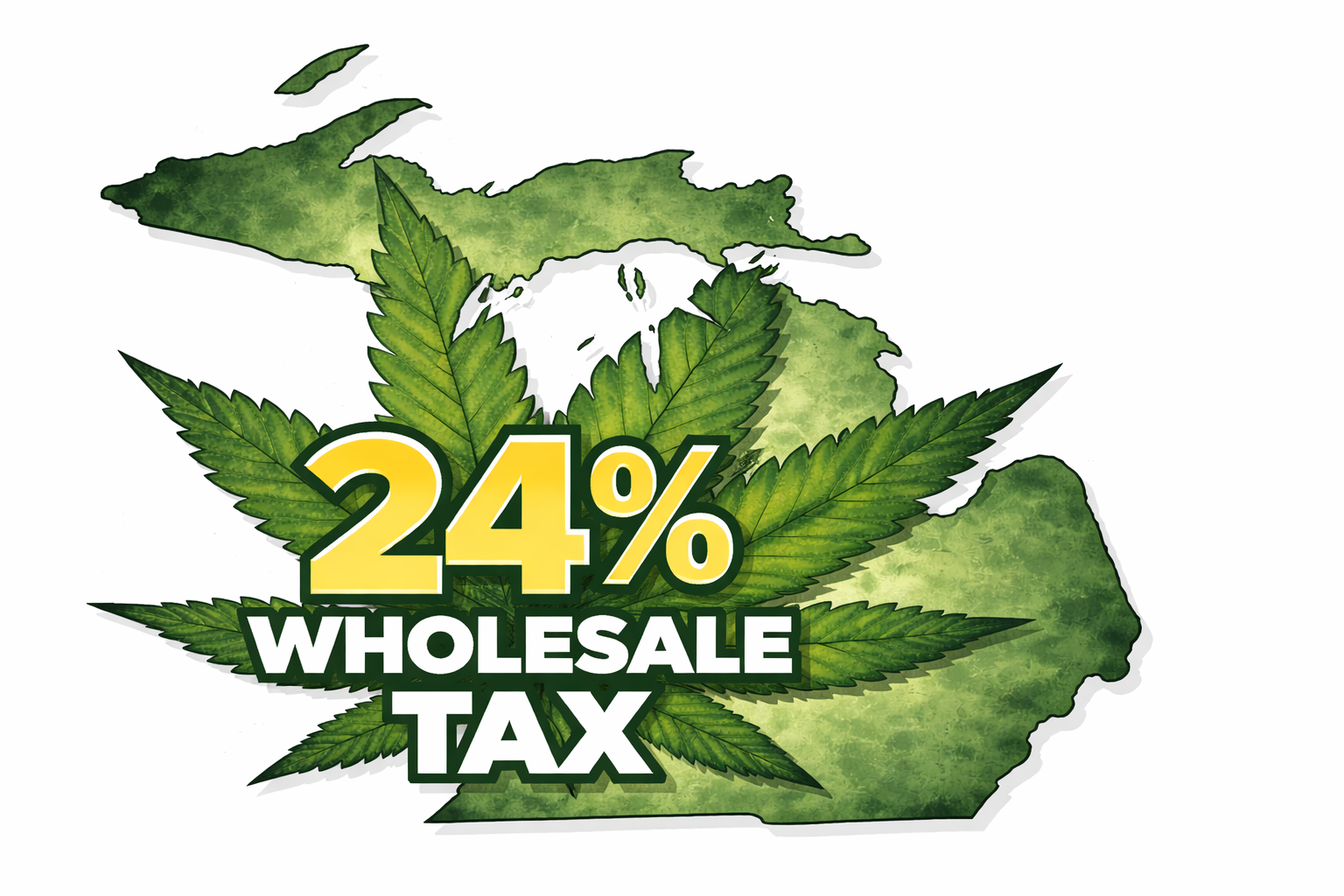

Michigan’s legal cannabis industry is entering 2026 at a moment of real vulnerability, as a newly enacted 24% wholesale tax takes effect in a market that has already slowed after years of rapid expansion.

What began as one of the country’s strongest adult-use cannabis markets is now contending with falling prices, store closures, job losses, and intensifying competition, which makes the new tax especially disruptive for businesses and consumers alike.

Since recreational marijuana sales launched in late 2019, cannabis has become a significant contributor to Michigan’s economy and public revenues. At the same time, more than 550 dispensaries and cultivation facilities have closed, and thousands of workers have lost jobs. But after years of steady growth, the industry showed its first signs of contraction in 2025. This contraction has been signifying that the market has entered a new phase defined less by expansion and more by survival.

According to data from the Michigan Cannabis Regulatory Agency, adult-use dispensaries generated $3.17 billion in sales in 2025, down from $3.27 billion in 2024. While a 3.1% decline may appear modest, it marks a significant shift for a market that had previously grown every year and helped position Michigan as one of the largest legal cannabis markets in the country.

“Michigan is a mature cannabis market, which is great for consumers but not always great for businesses,” a Michigan attorney who has spent nearly half of his 14-year legal career advising cannabis companies told Michigan Chronicle in an interview. “It’s highly saturated. There’s significant price compression, and margins are already razor thin.”

That saturation has driven prices to historic lows, making Michigan one of the most affordable legal cannabis markets in the country. While consumers have benefited from cheaper products and frequent discounts, many operators have been left selling at or near cost just to maintain foot traffic. For smaller, locally owned businesses in particular, profitability has become increasingly elusive.

Over six years, legal cannabis sales in Michigan have totaled more than $13 billion, generating approximately $2.2 billion in excise and sales tax revenue that supports schools, roads, and local governments. However, those figures are expected to decline further in 2026.

Read more at Michigan Chronicle