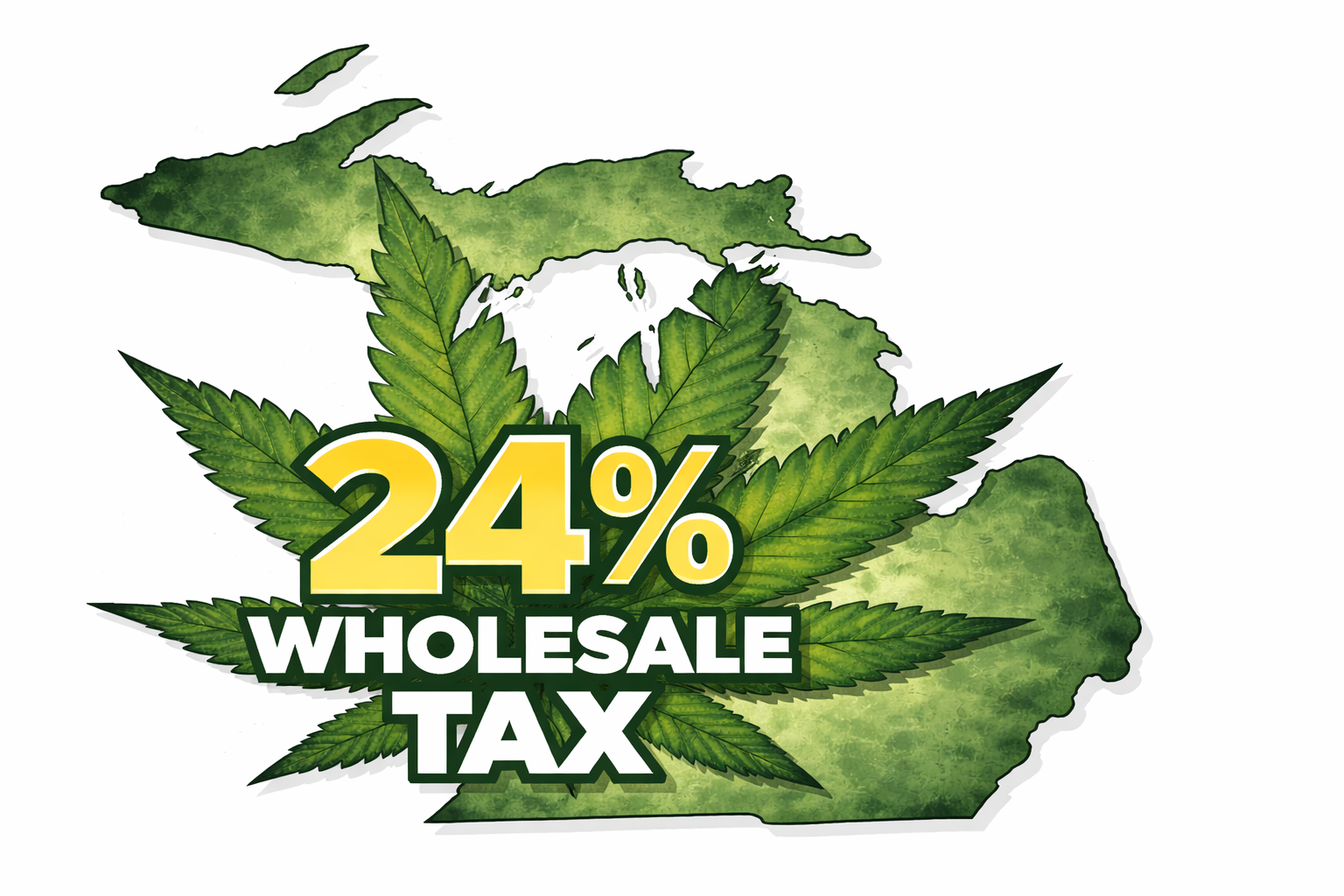

Despite the new 24% wholesale tax on marijuana going into effect on Jan. 1, the industry’s case against the state of Michigan is moving forward.

Court of Claims Judge Sima Patel denied a motion from the Attorney General’s office to reconsider her December ruling and toss the case.

On Dec. 8, Judge Patel denied a preliminary injunction from the Michigan Cannabis Industry Association to stop the wholesale tax, which is expected to financially constrain the already floundering industry, from going into effect.

But Patel did allow MICIA’s case to proceed on the grounds that the wholesale tax could circumvent the intent of the voter-initiated law.

The MICIA, an industry group representing 400 of the state’s marijuana operators, had argued in its lawsuit that lawmakers’ passing of the wholesale tax in October violated the state constitution because an amendment was required to change the voter-approved Michigan Regulation and Taxation of Marihuana Act (MRTMA), either by voters at the ballot box or by at least three-quarters of legislators.

The new wholesale tax was written into House Bill 4951, which was passed 78-21 in the Republican-led House and 19-17 in the Democratic-controlled Senate — short of the supermajority threshold in both chambers. Democratic Gov. Gretchen Whitmer signed it as part of a broader road-funding plan.

But it’s the intent of the law that Patel seems to be focused on and whether voters intended to legalize adult-use recreational marijuana sales as a means to deter illicit-market market marijuana.

Read more at Crain’s Detroit Business